We’re Committed To Financial Education

Posted by Kevin Gray 2nd March 20

As a Society, we are passionate about working with local schools and colleges to educate our young people to appreciate and manage money effectively. CEO, Kevin Gray, talks about the importance of financial education in schools and plans to encourage savings habits from a young age:

I was recently discussing mortgages with my youngest child Lucy. I mentioned to her that ‘interest only mortgages’ had lower monthly payments than ‘capital and interest mortgages’. I quickly realised by her blank stare that she didn’t have a clue what I was on about. After a quick explanation, Lucy stated that these ‘kind of financial things’ should really be taught in school. For a rare moment in our father/daughter relationship, we actually agreed with each other!

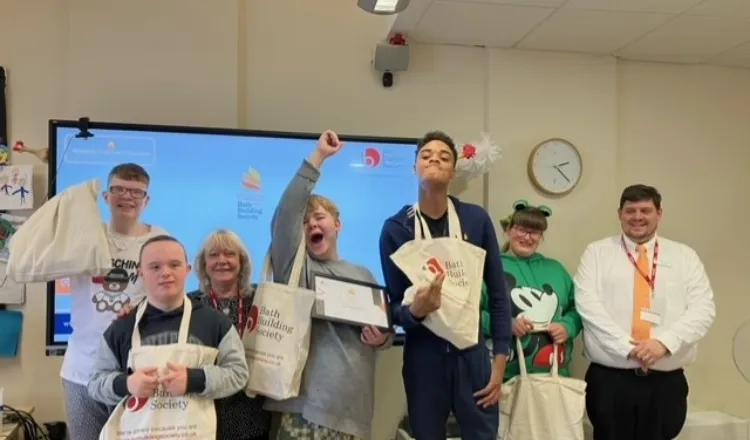

Bath Building Society has recognised that there is a general need for our young adults to learn more about useful financial and legal matters such as how to create a basic budget, how loans and mortgages work, and how to obtain and organise a rental property with friends. As such, we have prioritised the financial education of local school children within our social responsibility programme. In conjunction with WizeUp, a not for profit organisation that specialises in the delivery of seminars to sixth form students, I am proud to say that over 500 pupils in Bath state schools benefitted from our initiative in the 2018/19 academic year. We are encouraged by the reception that our initial programme of seminars received and have extended the programme to work with seven schools in the current academic year.

Although it is always nice to do good things, the Society does not aim to just be a ‘do gooder’ organisation. It has greater ambitions. We are in the business of changing people’s lives for the better by giving them security through promoting saving and by facilitating the means of them achieving home ownership. This is our social purpose and we intend to focus our energies towards doing things that are compatible with it. Although not specifically stated, our social purpose does lead us towards assisting the age group that is in most need of help i.e. the young. Let’s take a closer look at what we’ve been doing.

In common with many other Building Societies, the majority of our savings balances are held by people aged over 50. More worrying is the fact that many pre middle-aged adults have no savings whatsoever. We intend to try and do something about this. In order to encourage the habit of saving amongst our young adults, we will shortly be launching a regular savings accounts that will be made available to anyone aged between 16-25 who lives, works or studies in the BA post code areas. The interest rate of 5% variable (5% AER) per annum will compare very favourably with anything available elsewhere. The Society is also planning to launch a Lifetime ISA product later in 2020 with the aim of encouraging those under 40 to save towards a mortgage deposit.

First time buyers have to overcome many hurdles. Expensive rents make it hard for the young to save for mortgage deposits. House price inflation makes the scale of required deposits continually grow and the regulatory requirement to stress test mortgage payments makes affording a mortgage more difficult. It is remarkable that any first time buyers ever get a home of their own. I am delighted to say that, via our pioneering Buy for University Mortgages and Parent Assisted Mortgages, approximately 40% of our lending already goes to first time buyers. Your local Building Society wants to do better still and as such we are looking to expand our range of inter-generational support mortgages in 2020. This will include a Family Assisted Mortgage where family members can significantly reduce the monthly mortgage payments of another family member by foregoing interest on their savings balances. But what if the ‘Bank of Mum and Dad’ cannot offer any help? The Society will also be looking at introducing an innovative new product that will reduce the need for large deposits and also reduce the size of loans that need to be borrowed. This will increase affordability and with it the likely number of new first-time buyers.

As I approach the end of my second year as Chief Executive, the thing that I am most proud of to date is our unilateral decision to pay minimum starting salaries that are in excess of the ‘Real’ Living Wage as set by the Living Wage Commission. This measure predominantly helps our young employees and is the fair thing to do.

Bath Building Society wants our young people to better understand the basics of personal finances, it wants them to save for their futures and it wants them to get homes of their own. If we can be of any assistance to you or your family, why not give us a call on 01225 423271.

For my part, now that my Lucy understands how mortgages work, perhaps she’d like to take over mine? I’m not holding my breath!

The Regular Saver has a deposit limit of £10-50 a month and a withdrawal limit of 2 withdrawals per annum. Your home may be repossessed if you do not keep up repayments on your mortgage.

For our Buy for University and Parent Assisted mortgages, we require a collateral charge over a parental property and/or for the parent(s) to act as guarantor.