Investing In Our Young Adults

Posted on 18th October 22

In 2001, Tony Blair famously stated that the top priority of his government was, is and always would be education, education, education.

Whether or not his or later governments maintained their focus on education is a matter a political debate that I will not be going into here. However, I will come off the fence and say that for many years there has been a lack of investment in the field of financial education. Modern life is complex, and it has never been more important for our children and young adults to be taught the basics of financial transactions and the sound husbandry of their money. Sadly, with the financial and curriculum pressures that they have, our schools and colleges do not have sufficient resources or time to devote enough energy to this matter. Thankfully, local and regional Building Societies have long stepped into this void to provide money and resources to help the situation within the communities that they serve.

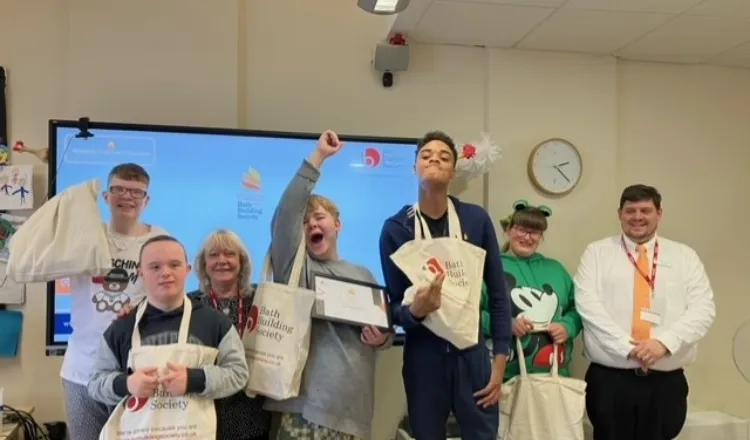

As the CEO of Bath Building Society, I am proud of our involvement in providing financial education to sixth form pupils in Bath state schools. In the 2021/22 academic year, we supported training initiatives in ten schools within Bath & North East Somerset and we intend to do the same in the forthcoming academic year. Bath Building Society provides the finance so that specialist tutors can deliver practical financial education sessions to pupils. These tutors work for a charitable organisation called WizeUp that works nationally with many building societies. These sessions support what activities schools can provide in the area of financial education and they are invariably found to be both interesting and popular with pupils.

The need for financial education does not stop once someone leaves High School, however. the Society has recently signed a sponsorship partnership with Team Bath, the University of Bath’s sports department. There are many aspects to this sponsorship but an important one of them will be the opportunity for senior executives to speak directly to undergraduate students about financial issues. Early topics will include the need to save for a mortgage deposit and how to get onto the housing ladder.

The social purpose of our Society is to improve the lives of its Members by promoting saving as a means of providing financial security and by facilitating lending to make aspirations of property ownership come true. Our purpose is particularly applicable to young people aspiring to become first time buyers. In my humble opinion, good habits are best formed at an early age. One such habit that BBS wishes to encourage is the regular saving of small amounts of money and to this end the Society has two regular saver products that are specifically targeted at young adults in the 16-34 demographic group. The 16-25 Regular Saver gives those in that age range the opportunity to save between £10 and £50 per month, whilst the Homestart Regular Saver gives those between 18 and 34 the opportunity to save between £50 and £250 per month. These products aim to get our young Members on a trajectory towards building deposits for their future property purchases. Both of these products offer interest rates that are favourable against average rates in the savings marketplace. Our mutual status means that it can take a strategic view to invest in growing the number of young Members despite any short-term negative impact on its average cost of funds. In summary, the Society is putting the long-term support for young Members ahead of short-term profitability because we think it’s the right thing to do.

Bath Building Society has developed two specialised mortgage products that are designed to get young adults onto the housing ladder. Our Buy For Uni product was developed in 2006 to advance mortgages to students and allow them to buy properties in university towns. After their studies have completed, the vast majority of student mortgage customers retain their properties as their own home or for long-term rental. The Society has also developed its unique ‘Rent a Room’ mortgage which allows first time buyers to borrow a higher multiple of their incomes in order to purchase bigger properties. We continue to work on new product ideas that will assist first time buyers.

For our young adults to become the leaders, entrepreneurs, public servants, business people and wealth creators of tomorrow, we must invest heavily in them today… as they are today’s future.