Profit is nice, but it isn’t everything

Posted on 1st May 23

Bath Building Society CEO, Kevin Gray, shares the story behind the Society’s performance reported in the Annual Accounts 2022.

Bath Building Society has recently published its Annual Accounts for 2022 in which it has reported an impressive 52.4% increase in profits before taxation. This strong profits performance means that, relative to its asset size, the Society remains one of the most profitable Building Society’s in the UK. I speculate that if these results had come from other businesses that have been more vulnerable to the current tough business environment, then we might have seen various chief executives doing cartwheels down Bath’s Milsom Street. Thankfully, my ageing back has been spared any celebratory gymnastics!

Bath Building Society is a mutual business that is owned by its customers. When customers open a savings accounts or take out mortgages, they automatically become ‘Members’ of the Society. My job, and those of my fellow 73 colleagues, is to put our Members interests at the heart of our decision making.

Unlike corporations who can issue shares to raise new capital, small mutual organisations have to rely on retained earnings to achieve this purpose. Profit generation (and hence new capital generation) is necessary to underpin future asset growth and to ultimately protect savers from incurring financial losses; if ever the Society faces a severe economic stress. Capital reserves are a good thing and the stronger the capital ratio of an individual Bank or Building Society, the stronger that Bank or Building Society is. Being in the somewhat luxurious position of having one of the strongest capital ratios in the sector, and with the absence of shareholder pressure to maximise the payment of dividends, Bath Building Society is under far less short-term pressure to generate profits than most other businesses. This allows the Society to prioritise the protection of its savers and borrowers ahead of maximising profits and it also gives it greater flexibility to take investment decisions. Our strengthened profitability is very welcome, but there is much more to the Society than the pure pursuit of high returns.

We have a social purpose that is greater than just making money. It exists to change the lives of Members by encouraging saving as a means for them to achieve financial security and by advancing loans to them to enable their dreams of achieving home ownership. I believe that it is the achievement of these loftier goals, which make ‘a real difference’, that get me out of bed in the morning and which make working for the Society so special.

The Society is investing in its people, its technology and its processes in order to improve the experience that our customers get when they do business with us. We have recently introduced a Mobile App that provides customers with a further option as to how they can transact with us. This places Bath Building Society amongst a handful of building societies that can offer this functionality. We have also improved our online affordability tool to support applications from our mortgage Intermediaries. Having made a big effort to improve the handling of a growing number of customer enquiries, our reviews from customers are exceptionally strong.

The Society wishes to be an employer of choice within Bath. It has achieved a major success in being able to recruit a growing number of excellent people in what has been a very competitive employment market.

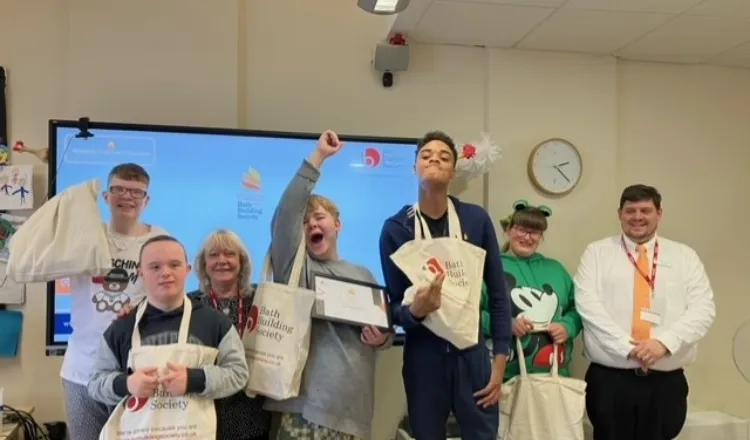

Investing in the local Bath community is part of the DNA of Bath Building Society. A few of our recent initiatives include an expansion of our investment in financial education within schools, small charities and for local tree planting. Every colleague can spend one day per year supporting local charity work and we have introduced a matched fundraising scheme to support our colleagues who wish to raise funds for the Society’s Charity of the Year.

At our 119th Annual General Meeting I explained to attending Members why I believe that our increased profitability has not come at their expense. I demonstrated the competitiveness of our products and used real comments from real customers to show how our Members appreciate our fair approach. Important as profit is to us, it is our investment in our customer journeys, our people and our community that I am most proud to communicate. I am of the firm belief that by focussing on making a difference in these areas, future profits will look after themselves.