New report urges employers to boost financial wellbeing through workplace savings

Posted on 24th June 22

A new Building Society Association (BSA) Workplace Savings Report has been released, looking a why employers might want to help employees by offering a workplace savings scheme, and how this could work.

The report, which draws on a YouGov survey of 2,000 people, found:

- The majority think that their employer should care about their financial wellbeing

- 50% who don’t currently have a workplace savings scheme are interested in one

- Over six in ten employees are finding bills and credit commitments a burden

- Close to one in five employees would not be able to cover their living expenses for one month if they lost their main source of income

The Covid pandemic and the subsequent rise in the prices of energy and other commodities has highlighted the vulnerable financial position of many households. Even prior to the pandemic, 11.5 million people had less than £100 to fall back on if they got into difficulty.

Many households are now finding their finances stretched by rising prices but for those that are able, regularly putting a little aside can help to soften the blow from future unexpected events and give greater peace of mind.

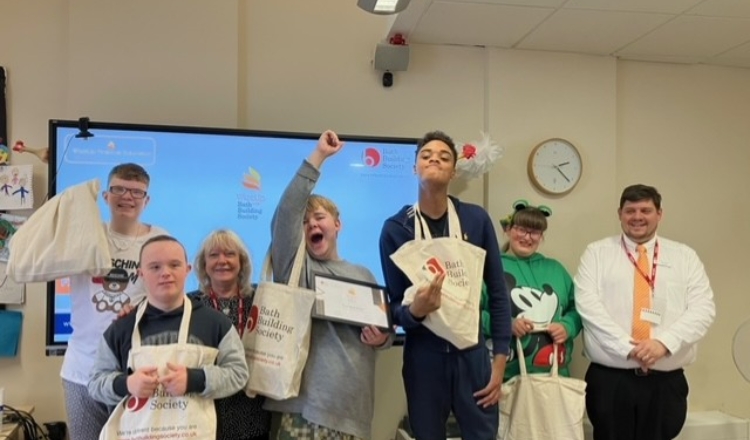

Many people see the benefit in saving, but often it is hard to maintain those good intentions against other demands and temptations to spend. One way that people who are in work might be helped to develop a pot of savings is if their money was moved on their behalf into a simple savings account straight from their pay. Find out more about the Bath Building Society Payroll Savings scheme and how we can work with your business to implement workplace savings.